CRTPro

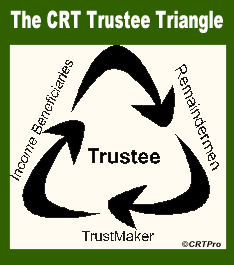

The Trustee Triangle

|

For the year 2007,

the IRS reported that 115,754 charitable remainder trusts filed

informational returns. Each trust names a trustee or multiple

trustees. These trustees are broken down into three main categories;

Each

category has its advantages and disadvantages. Banks and

trust companies commonly

have trained trust account executives and a legal review department.

The larger non-profit organizations will normally have a business

office and planned giving officers. Individual trustees are usually

CPAs, attorneys, or self-trustees. Regardless of size

or skill, all have something in common—serving as a CRT

trustee is a very important and, at times, demanding role. The

trustee is positioned right in the center of the CRT triangle.

"The Trustee

is positioned right in the center of the CRT Triangle."

The CRT triangle

illustrates the fact that a charitable trust is a three party

arrangement among (1)the trustmakers, (2)the income beneficiaries,

and (3)the remainder beneficiaries. It is this multi-party

arrangement that causes the CRT to be referred to as a split

interest trust. Each party looks to the trustee to direct the

trust with everyone’s best interests in mind. The trustee

serves as fiduciary and must make difficult decisions about

valuation, investment, administration, and management of the

trust.

"...decisions

must be made with impartiality to each party

in the trustee triangle."

These

decisions must be made with impartiality to each party in the

trustee triangle. A CRT trustee must always ask itself the following

questions. Are the trust donors happy? Are the income beneficiaries

happy? Are the remainder beneficiaries happy? An effective CRT

trustee will be able to serve all three parties and keep the

trust in compliance with government regulations. These

decisions must be made with impartiality to each party in the

trustee triangle. A CRT trustee must always ask itself the following

questions. Are the trust donors happy? Are the income beneficiaries

happy? Are the remainder beneficiaries happy? An effective CRT

trustee will be able to serve all three parties and keep the

trust in compliance with government regulations.

next

page...The TrustMaker

©CRTPro

2004

|